Maximizing Your Income: Understanding Australia's Stage 3 Tax Cuts

Learn about Australia's stage 3 tax cuts, and how they impact income, tax brackets, and investment opportunities, boosting financial prospects nationwide.

Maximizing Your Income: Understanding Australia's Stage 3 Tax Cuts

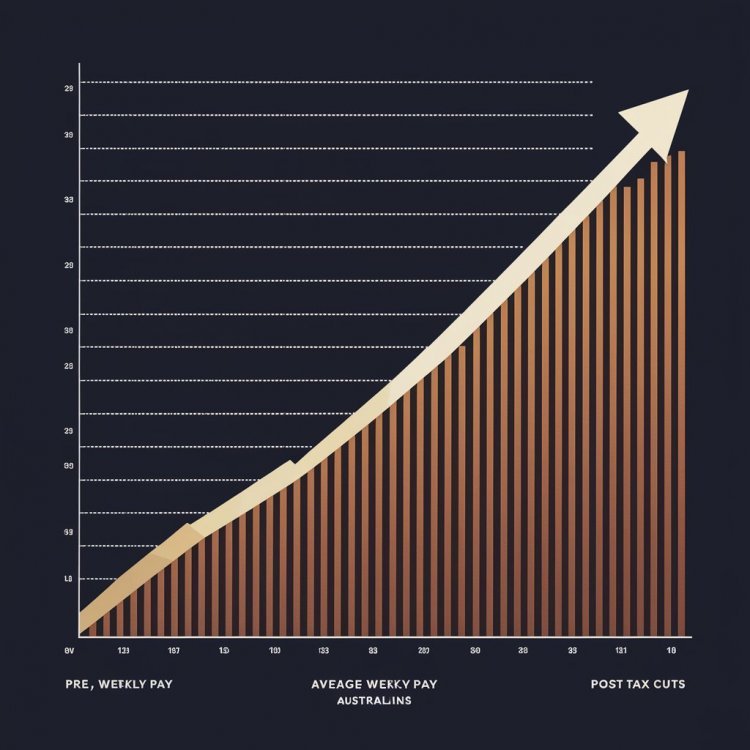

In a significant move aimed at bolstering household incomes across Australia, the federal government has introduced stage 3 tax cuts that promise to put more money back into the pockets of working Australians. These tax cuts, set to roll out in the upcoming fiscal year, are expected to have a tangible impact on the finances of millions, potentially altering spending habits, savings strategies, and investment decisions nationwide.

What Are the Stage 3 Tax Cuts?

The stage 3 tax cuts are part of a broader initiative by the Australian government to reform the tax system, aiming to simplify brackets and reduce the overall tax burden on individuals. The centerpiece of these reforms is a restructuring of tax brackets and rates, which promises to increase disposable income for a vast majority of taxpayers.

Impact on Average Australians

For the average Australian, these tax cuts translate into a noticeable increase in take-home pay. On average, individuals can expect an additional $36 weekly or approximately $1,888 annually. This boost comes at a crucial time when many are navigating economic uncertainties and rising living costs.

Changes in Tax Brackets

The restructuring of tax brackets under the stage 3 reforms is designed to benefit lower and middle-income earners primarily:

-

Reduction in the 19% Tax Rate: Individuals earning between $18,200 and $45,000 will see their tax rate decrease from 19% to 16%. This adjustment aims to provide immediate relief to those in lower income brackets, ensuring more money stays in their pockets.

-

Adjustments in Higher Income Brackets: For those earning between $45,000 and $120,000, the tax rate will be reduced from 32.5% to 30%. This change acknowledges the contribution of middle-income earners to the economy while easing their tax burden.

-

Threshold Adjustments for Higher Tax Rates: The thresholds for the 37% and 45% tax rates will also be adjusted upwards:

- The 37% tax rate threshold increases from $120,000 to $135,000.

- The 45% tax rate threshold rises from $180,000 to $190,000.

These adjustments are aimed at ensuring that higher-income individuals continue to contribute proportionately while benefiting from more straightforward and transparent tax obligations.

Investment Opportunities and Financial Planning

Beyond immediate spending power, the stage 3 tax cuts present opportunities for savvy individuals to enhance their financial positions through strategic investments. Experts suggest that those able to invest their tax savings wisely could potentially earn returns exceeding $10,000 annually. This presents a compelling opportunity for Australians to bolster their savings or investments, contributing to long-term financial security.

Economic Implications and Future Outlook

The implementation of these tax cuts is expected to stimulate consumer spending, providing a boost to the broader economy. Increased disposable income often translates into higher consumer confidence and expenditure, benefiting businesses across various sectors.

Looking ahead, the government anticipates these reforms will not only support economic recovery but also incentivize workforce participation and encourage entrepreneurship. By putting more money directly into the hands of taxpayers, the stage 3 tax cuts aim to foster a more resilient and dynamic economy.

Conclusion

In conclusion, Australia's stage 3 tax cuts represent a significant step towards enhancing the financial well-being of its citizens. By restructuring tax brackets and reducing rates, the government aims to provide immediate relief to individuals across income levels while stimulating economic growth. Whether through increased disposable income for everyday expenses or strategic investments for future financial security, these reforms are set to have a transformative impact on the financial landscape of Australia.

As these changes take effect, individuals are encouraged to consult financial advisors to maximize the benefits of these tax cuts and make informed decisions that align with their long-term financial goals. With careful planning and prudent investment, Australians can seize the opportunities presented by these tax reforms to secure a brighter financial future.

What's Your Reaction?